While preparing this article about the Lightning Network I considered severeal headlines and even after publishing I am not sure, if I chose the right one.

My alternates:

Bitcoin is dead, long live Bitcoin!

or

The Lightning Network no revolution without evolution!

or

Bitcoin is going to invent itself — again! Understand the Lightning Network!

They all somehow express what I want to explain to you.

But from the beginning. As you maybe know I am in Bitcoin since 2013. First as a home miner and ocassionally and later regulary as a trader. I sticked to Bitcoin for years as it was a hobby which led to ongoing discussions with my wife how much my hobby is worth when she paid our power bill. She showed great understanding at that time and supported me always. When trading in my early Bitcoin times I sold Bitcoins at a rate of 200 to 500 USD and enjoyed the revenue. Sometimes I hold more than 30 Bitcoins. I wished I had the knowledge of today those days. ?

Then 2017 came and the Bitcoin exchange rate exploded, while the ongoing discussion about scaling led into an open war between different factions and controverse compromises. At this point I don’t want to go deeper into this, but eventually it led to several forks from Bitcoin and a high peak of Bitcoin’s exchange rate at around 20,000 USD. Then the long fall and todays Bitcoin’s fight against a strong bearish resistance line while recovering.

Is bitcoin a fail?

Is this really the end? Do all the cries of naysayers to be proofed right? Was Bitcoin that giant bubble all the experts called it again and again and again?

Bitcoin was invented as a peer-to-peer value transfer system with elimination of trust of a third party. It was planned as an instrument to bank the unbanked and to be available all over the world. But as a genius Satoshi Nakamoto was he didn’t foresee that it had imminent flaws. Satoshi did probably not expect that ASIC would be invented. I am pretty sure, if he did, he made the mining/minting algorithm some more complex to keep it on CPU/GPU as long as possible. Maybe he just didn’t care. The success of mining pools was maybe originally also not expected or even intended. Bitcoin’s idea was a distributed ledger and decentralization. The forming of pools are exactly the opposite and in the end led to the idea in some big miner and mining equipment hardware supplier’s mind that they “own” Bitcoin or operate it and they would not give up to put their claws in their money printing machines which provided them so much wealth in the last years.

You can still find that attitude at the Bitcoin Cash (an altcoin created as a fork from Bitcoin) supporters like Jihan Wu or Roger Ver who try to mislead people what Bitcoin really is. (BTW: In their argumentation they stick close to Bitcoin’s original whitepaper but take not into consideration that you need to develop something if you realize the flaw and that only that what people accept as Bitcoin will ever be Bitcoin. They changed their manipulation tactics some, but please be aware, that Bitcoin Cash is NOT Bitcoin — and not supporting SegWit it will never be.)

Third big flaw of Bitcoin was that its exchange rates’ meteoric rise lured more and more even big institutional investors into Bitcoin. At the same time Bitcoin as a payment option was more and more turned down, because due to the long-lasting scaling debate the transaction fees turned exorbitant high. Suddenly Bitcoin was an object of speculation and Joe Everybody could not afford it anymore, which kept many not from buying it even they did not understand the market mechanism working there of understanding Bitcoin as a technology at all.

If you look at this three flaws insulated you have already a good impression of the actual situation, but you need to dig some deeper to uncover the real problem Bitcoin has and which urgently needed to be solved. Bitcoin’s intent was to be some kind of currency, but it is/was more something like a commodity. Of course you could buy this or that in webshop with Bitcoin, but within a few month the value was so high that the fees ate up the transfered value. Nobody really wanted to accept Bitcoin. Sellers, merchants and store owners saw it more like a hip payment channel not like a reasonable competitor to VISA, Paypal or Fiat Money. The success of Bitcoin and its volatile exchange rate made it impossible to be used as a currencies and all the imminent flaws worked together to drag it into direction to be a value storage and that made all the yells “Bubble! Bubble!” became a self-fulfilling prophecy.

From that point of view it is true: Bitcoin — as a currency — is a fail.

And the future?

Bitcoin is a fail, but it is not an epic fail, because a small bunch of resistant developers realized already years ago, where Bitcoin’s problems lay and how to solve them. Let me draw you a picture, which does not claim to be true in detail, but please allow me to take your hand and lead you to the right direction with a little weird idea.

Join my in the rabbit hole of conspirancy theories where Alice is waiting for us already masked as the bitcoin inventor Satoshi Nakamoto. It is up to you to believe who he is, but did you never wonder why he totally disappeared from the scene after he started with so much effort to create Bitcoin and to explain his ideas to others? Why he showed the concepts and realized an implementation of its vision, inspired lots of developers, cryptographers and mathematics worldwide without even once to step out of anonymity? I am sure he planned from long hand to pass the baton to others and then to watch from another perspective and/or to take care of other things. Or?

Nakamoto created a website with the domain name bitcoin.org and continued to collaborate with other developers on the bitcoin software until mid-2010. Around this time, he handed over control of the source code repository and network alert key to Gavin Andresen, transferred several related domains to various prominent members of the bitcoin community, and stopped his involvement in the project. Until shortly before his absence and handover, Nakamoto made all modifications to the source code himself.

Wikipedia contributors. “Satoshi Nakamoto.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, 24 Jun. 2018. Web. 26 Jun. 2018.

I can not imagine he didn’t make sure that his “Bitcoin: A Peer-to-Peer Electronic Cash System” was in good hands before leaving. There are rumours that Satoshi could even be that group of people (or part of it) who are nowadays known as “Bitcoin Core”.

Now the weird imagination: The romanticist in me has an idea of a secret society of around five to ten people who share parts of a private key which can unlock the first 1 million minted Bitcoin if used together under certain conditions like a specific blockheight or amount of Bitcoin in circulation.

Sure is that that the group called “Bitcoin Core” never spent much time on marketing, put themselves in the center of attention or made a big fuzz about their person, but they put much effort in developing Bitcoin in a sustainable way. The discussion about scaling led to struggle, but Bitcoin Core never gave up any ground and let the users decide. They never cared if other trends in the community led to the creation of altcoins and how much that new coins were adopted or took market cap from Bitcoin. They ignored Turing machine-like developments like Ethereum more or less, but were willing to cooperate with cognate cryptos like Litecoin, Groestl or Dogecoin for mutual advantages and — at least that was my impression.

So SegWit as the main requirement for further developements of the Bitcoin protocol eventually had been activated successfully and that was like a starting shot for developers worldwide. I think that was what the Bitcoin Core group was aiming for, because they are aware for a long time already that the activation of SegWit if essential to turn Bitcoin from a failed speculation bubble into a successful full digital peer-to-peer payment network. SegWit’s support helping solving the scaling problem is only a bonus on the top. Bitcoin Core insisted on 1 MB blocks. If scaling was the big issue there have been solutions around like bigger block sizes and even Jeff Garzik’s lukewarm compromise (Sorry, Jeff, I have respect to you and your work! All the best for Metronome — even I think it will be obsolete within a few years) SegWit2x. By the way: The only initiative which really made SegWit possible was the UASF anyway — my two cents.

So if solving the scaling problem was not the reason to insist on SegWit and 1 MB small blocks and even let users build up pressure under which Bitcoin could break then the only reason I can see is in another use of SegWit and it already took me days to understand that only one further development can be the reason for.

SegWit conditiones several possibly deployments to the Bitcoin protocol and the installation which instrumentalizes Bitcoin’s blockchain as what it really is: A giant decentralized self-organizing public database which holds data about who owns how much. On top of this database shaking of the chains of underlying flaws Bitcoin comes to the surface again in the Lightning Network.

Frolicking, the savior is near!

The lightning network fulfills all the promises Bitcoin made in the past. There a better sources to explain the details to you like

- https://lightning.network/

- https://decentralized.blog/the-lightning-network-rookie-guide.html

- https://medium.com/@argongroup/bitcoin-lightning-network-7-things-you-should-know-604ef687af5a

but let me give you this brief introduction:

The Lightning Network is NOT a new currency, there will be NO ICO or swap or something. The Lightning Network does principally something like that: Everybody with a client can take part at the Lightning Network and with every connection a self-organizing meshed network is established. Thanks to the simplicity of the Bitcoin protocol every lightning network node can create hash values which can be anchored in the Bitcoin blockchain without being already “recorded”. They’re like a hook or a bookmark in the blockchain.

If Alice wants to send Bitcoin to Bob she now can use that hook to open a direct channel to Bob on the Lightning Network. That channel is established over others members of the network. These hops have no clue about the content of the transactions they transport. They can also not stop it or influence it. They just build up a chain of trust. After the channel between Alice and Bob is established they can exchange Bitcoin in both directions for no fees. They can write each other invoices or settle payments. All the information if only hold in that channel and it is constructed in a way that it has a mutual agreed state (consenus) at any time. So even if a network connection breaks the Bitcoin in the channel is save. After all transactions are done the channel is closed, but only the result is written in the blockchain.

But the great advantage: If you made a Bitcoin payment with the Lightning Network you don’t need to care for the 6 times confirmation time. The Bitcoin is already transfered and accepted within the channel. The transaction is already negotiated and the outcome non-reversible settled. The Blockhain is only recording the result after closing the channel. And after 6+ confirmations the recording is non-reversible, too.

The Lighning Network adds all the features to Bitcoin you always wished:

- Instant transactions with the speed of light

- Low to no fees for low transactions

- Low volume transactions down to 1 Satoshi

- No direct public inview in your transaction history

- Easy swapping of Bitcoin to Litecoin, Groestl or Dogecoin within the channel (Atomic Swaps)

- Due to its p2p-nature the Lightning Network is “unblockable”

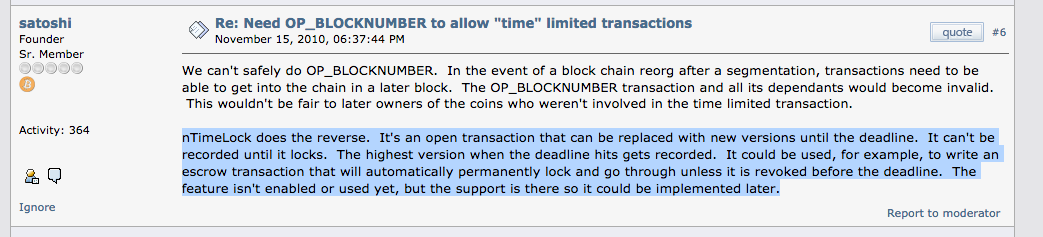

That opens varied use cases for really all involved parties. Please think about it! Bitcoin will turn from a commodity to a real worldwide used currency. Merchant can finally implement Bitcoin payment. Starbucks could let you pay your coffee within seconds. Facebook could reward commercials with paying Bitcoin and you could eventually tip people on the fly with your mobile. Webshops supporting the Lightning Network are not futuristic dreams, they are already reality. That was what Satoshi had in mind when Bitcoin was created! The Bitcoin Lightning Network was already introduced to people and presented by Satoshi in November 2010!

This is already a description of how the Lightning Network works.

Please take you a minute and make some conclusions, and you will realize that the Lightning Network is a revolution of the revolution Bitcoin. It is the only reasonable development to let Bitcoin become a usable real-world payment option. That will resolve all problems Bitcoin actually shows. Bitcoin does not need HODLers any more. To hold Bitcoin long-term is completely contra-productive, but unfortunately actually the only option for small investors to compete with institutional ones (and the monetary power of whales) to carry the wealth through the long waiting time until Bitcoin will become a useful, less volatile currency and “go mainstream”. You think that already happened? It didn’t. Bitcoin caught a lot of media attention, but is still far from mass adoption. Even if you are deeply interested in Bitcoin how many people you know using Bitcoin for payment in real life?

But don’t worry the time is near!

HODL now, use later!

As long the Bitcoin exchange rate is highly manipulated by whales and speculator whim and the fiat-to-digital transformation is in progress everybody HODLs and is withdrawing liquidity from Bitcoin. With no or low liquidity the use of Bitcoin is extremly limited and merchants step back from implementing tools to accept Bitcoin payment. Without merchants accepting Bitcoin and trading goods or services against it it has no use case and the interest in Bitcoin drops. The propagated use “Bitcoin holds value” like gold isn’t really existing, because Bitcoin is backed by what people are valueing it. It is more like a piece of modern art — and you know how different the evaluation can be.

The Lightning Network will break this vicious cycle. Bitcoin will go mainstream and latest when people overcome this realization Bitcoin will reach a new all-time high. I guess the big players already realized that, if the Bitcoin price goes up again sustainably it could have been the last time you saw it traded at a 4 digit price. The Lightning Network is far developed, so maybe you will stunning surprised in 2018. Even if not — you will have more time to collect BTC.

Three groups are eagerly working cooperative on the Lightning Network.

There are

- lnd — an Lightning Network client with optional use of light clients later, also hooks for several visualizing options

- eclair — an elegant implementation (focusing on mobile devices — I am not sure)

- clightning — Lightning Client written in C, beta status already, providing base for several apps like payment plugins for woocommerce, tipping, or payment per article

All three are very far developed. clightning is already used on the mainnet and in beta state as I know.

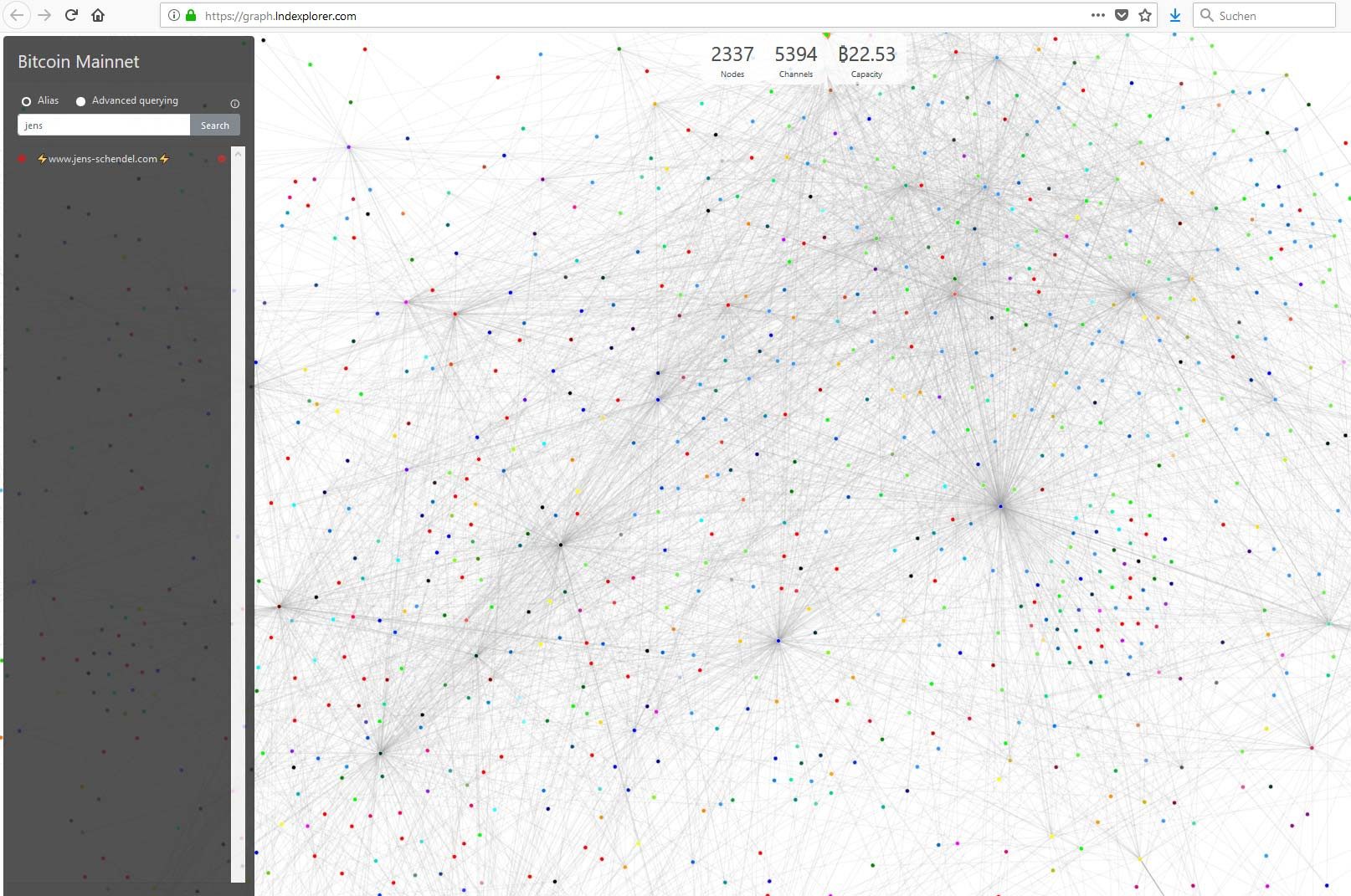

Although it is not recommended to use the mainnet at the state of writing there are 2337 Lightning Nodes with 5394 channels spanning a the mainnet holding 55.53 BTC.

Bitcoin exchange rate is about 6150 USD. In my opinion his is not a pity, but this could be your last chance to hop on the train heading wealth valley!

I published this article first on MEDIUM. If you want to learn more about the Lightning Network explore this Linklist.

I operate my own little Lightning Node

Feel free to open a channel e.g. with

clightning

lightning-cli connect 0366217f4a7abf70842f794e94a4cbddc249d5cbaf9c0ffd0b7e4638d9bf07845d 81.7.17.202 9735

lnd

lncli connect 0366217f4a7abf70842f794e94a4cbddc249d5cbaf9c0ffd0b7e4638d9bf07845d@81.7.17.202:9735

eclair

eclair-cli connect 0366217f4a7abf70842f794e94a4cbddc249d5cbaf9c0ffd0b7e4638d9bf07845d@81.7.17.202:9735

(please be note that you have to remove hyphens from the line above, after copy/paste somewhere) or try my already working online tipping tool. Check it out! Send me some Satoshis throught the Lightning ⚡️ Network (beta, but fast as lightning!)